Treasury departments have significantly increased their spending on treasury technology in the past few years, and this trend continues to move in an upward direction. This spending increase is driven by factors originating inside and outside of the treasury department. As treasury staff face rising expectations and demands from executive management and the board, they must continue to leverage lean resources to meet these expectations, while maintaining their daily responsibilities. Treasury technology is almost always part of the optimal solution to a seemingly unsolvable challenge. While an assessment, selection, and implementation of a new system may take a significant amount of time, money and hair, treasury departments find the easing of tension significant once the system is successfully implemented and running smoothly. Their daily tasks become easier to accomplish and performing a new one-off analysis or modeling different scenarios, becomes significantly easier. This article looks at 10 of the top 20 trends and developments in treasury technology.

Significant Treasury Technology Spend

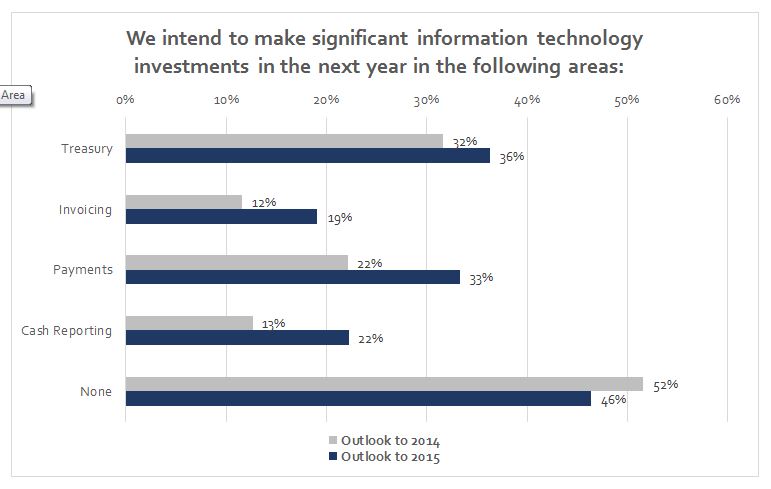

Strategic Treasurer’s Treasury Technology Survey results demonstrate that corporates intended to spend even more this calendar year (2015) than in the past. As you can see in the accompanying graphic, the intention of the survey respondents to spend significantly more increased in all four areas queried: Treasury, Payments, Cash Reporting and Invoicing. As the spend survey question from prior years used a different phrasing and can’t be directly compared, we interpret the results as showing that over the course of multiple years, treasurers have increased spend significantly on treasury technology.

(Strategic Treasurer & Bottomline Technologies 2013 & 2014 Cash Forecasting Survey)

(Strategic Treasurer & Bottomline Technologies 2013 & 2014 Cash Forecasting Survey)

SaaS and Fully-Hosted Options Reach Near-Total Domination

Examining the TMS/TRMS space more carefully, it is clear that SaaS providers have had enormous growth and continue to run red hot. The largest publicly disclosed investments and major pushes into new markets have all occurred within companies experiencing some of the highest growth rates and deploying their solutions via a SaaS or fully-hosted model. As more companies become accustomed to the SaaS models in other areas of their business, treasury has increasingly selected these delivery methods due to the virtual flexibility and ease of maintaining important systems. Most treasury groups that already struggle to find adequate IT support, find the amount of care and feeding installed solutions required increasingly less palatable.

Rising Tide and Some Thrashing In the Water

As treasury departments rapidly turn to treasury technology, a number of treasury technology providers become strained as their resources are sapped and they are unable to complete implementations as efficiently and quickly as they would like, given the stress from sheer volume. This rising tide is lifting many boats or technology vendors. While some are experiencing growth that makes their sales groups delighted, their professional services teams find themselves thrashing about in the water due to the escalating demands.

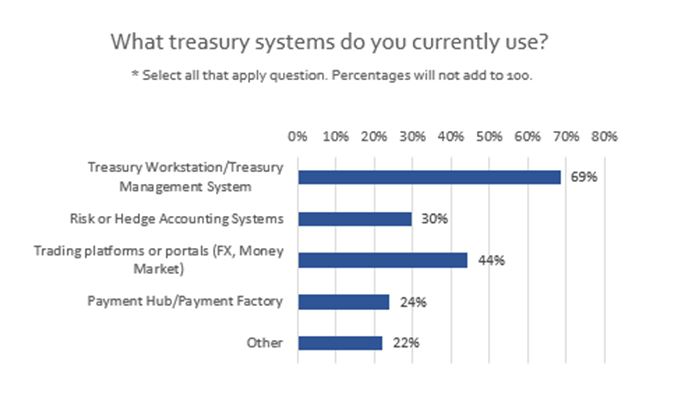

(Strategic Treasurer 2014 Rapid Research: Technology Use Survey)

(Strategic Treasurer 2014 Rapid Research: Technology Use Survey)

High-Touch Specialists

Many corporates, hoping to side-step the possibility of delayed implementations, are turning to some high-touch specialists—vendors who have a slower growth model as they focus on adapting their solution to a client’s core needs and providing an extra measure of care. Some of these vendors are experiencing relatively strong growth as clients are seeking to acquire a more ‘custom’ system. Examples of some of these firms with this type of strategy or focus include: Chesapeake, Financial Sciences and Orbit TMS.

From Consolidation to New Providers.

In the not too distant past, the TMS/TRMS space seemed marked by consolidation. Firms acquired other firms in this space, which led to very few new vendors entering the market. That has changed significantly. Some new providers are bringing additional functionality and service models to the ever-changing TMS/TRMS space. These new providers are already starting to impact the market. We expect this impact to increase over the next few years as they leverage modern technology and services to provide new solutions. Some of the new players who are most notable in the North American Market include: Axletree’s TreasurYtree, Bloomberg and TreasuryXpress.

Risk Analytics and Risk Visualisation

Because of today’s ever-shifting economic climate and financial volatility arising from currency, commodity, or country level risks, treasury is pursuing great risk capabilities from their technology providers. As a result, significantly more development funds are being deployed to support flexible self-service reporting and analysis in various treasury systems. Most of the development has been spent beefing up analytical capabilities, improving dashboards, and providing better graphics and other visualisation tools. Systems can now deliver not just a PDF, but ‘smart’-reports, dashboards to actionable cockpits, often leveraging business intelligence tools or technology. This adds to the self-discovery and self-service capabilities of these systems, which increases the appeal and efficacy. This democratisation of data is important as more team members are able access information on their own, which itself layers in another type of visibility.

Improved Integration

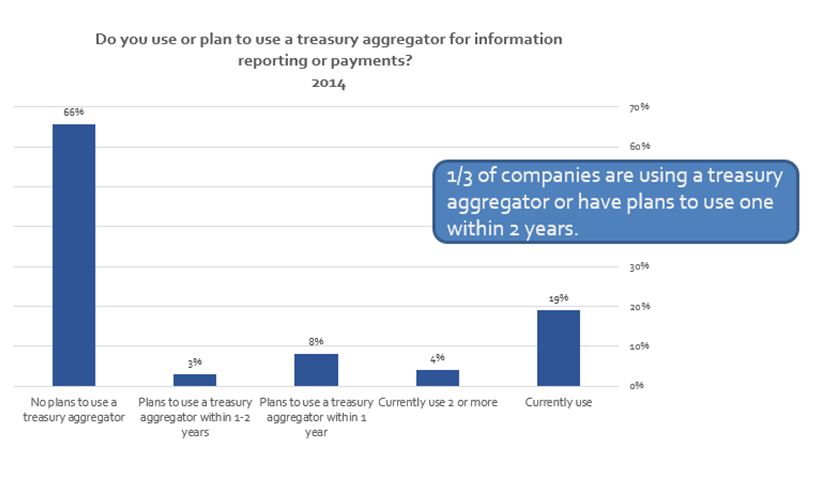

TMS core systems are offering better integration capabilities with various best of breed providers across the treasury technology landscape. The type of integration can take on different forms with a qualitative difference from the treasurer’s perspective. This includes standard file feeds, improved APIs and a more or less transparent vendor supported integrated process. These elements are significant for the consideration of connectivity and visibility, specifically in relation to cash and counterparties. Cash modules, which consume significant amounts of banking data, moved past the inflection point of adoption several years ago. The use of treasury aggregators and straight up payment hubs is on the rise, and the service that is offered continues to expand and become more enriched with capabilities such as the file/transaction validation and repair and OFAC sanction filtering. With the continued emphasis on SEPA, OFAC, and low-cost payments, these providers are able to bring their customers on board more efficiently, without the labor of building and supporting numerous individual connections over and over.

Formats Matter

The view that formats play a very important role is increasing. The newer, more flexible and able-to-be-enriched formats offer better current and future value to a treasury department’s systems and processes. Vendors who can leverage the ISO20022 format offer an improved level of flexibility and better position organisations for forward-thinking developments and process improvements.

Increased Emphasis on Bank Account Management

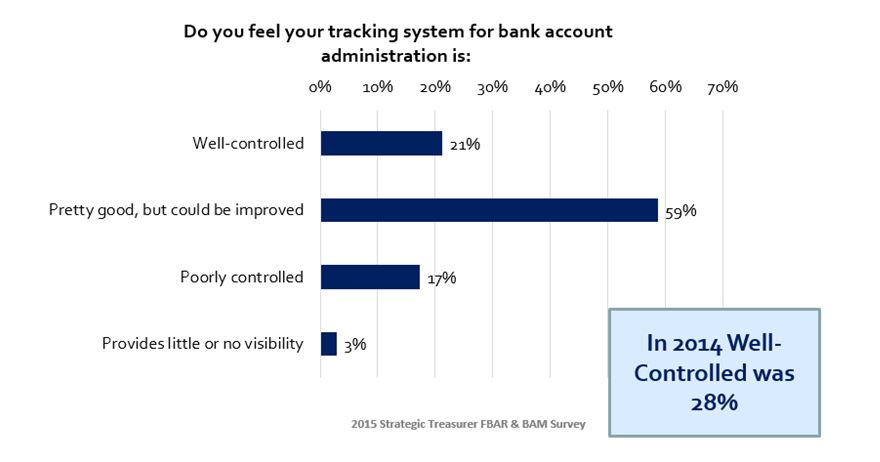

As regulations, such as FBAR, continue to cause headaches for treasury departments as well as the continued globalisation of companies (adding more US signers on foreign bank accounts), there is an increased corporate interest in BAM tools. The technology behind these tools continues to be developed to keep pace with the current demand, as vendors seek to provide helpful and functional BAM tools to their customers. These regulations force companies to use their bank account data more thoroughly, which exposes weaknesses in the BAM process. More firms are recognising that perhaps their BAM process is not in the excellent category.

This more realistic view is healthier and treasury executives continue to look to both TMS and specialist providers to offer solutions to these critical requirements.

This more realistic view is healthier and treasury executives continue to look to both TMS and specialist providers to offer solutions to these critical requirements.

Calibrated Needs

Treasury departments continue to recognise that their needs may differ from other organisations. The level of treasury intensity across a range of dimensions may require a more calibrated approach, which in turn, may require the use of best-of-breed systems for certain functions. This is noticeable in several areas as companies turn to payment hubs for the aggregation and management of their payments globally, demand deeper capabilities, and require additional risk management functionality across a range of technology categories, all to better meet the demands they are facing.

(Strategic Treasurer & Bottomline Technologies 2014 Cash Forecasting Survey)

(Strategic Treasurer & Bottomline Technologies 2014 Cash Forecasting Survey)

Craig Jeffery formed Strategic Treasurer LLC in 2004 to provide corporate, educational, and government entities direct access to comprehensive and current assistance with their treasury and financial process needs. His twenty-plus years of financial and treasury experience as a practitioner and as a consultant with various financial institutions have uniquely qualified him to help organizations craft realistic goals and achieve significant benefits quickly. He is primarily responsible for relationship management and ensuring total client satisfaction on all projects. Additionally, he oversees the development of all practice areas and staff.

Craig Jeffery formed Strategic Treasurer LLC in 2004 to provide corporate, educational, and government entities direct access to comprehensive and current assistance with their treasury and financial process needs. His twenty-plus years of financial and treasury experience as a practitioner and as a consultant with various financial institutions have uniquely qualified him to help organizations craft realistic goals and achieve significant benefits quickly. He is primarily responsible for relationship management and ensuring total client satisfaction on all projects. Additionally, he oversees the development of all practice areas and staff.