With reports that Visa Inc. is in talks to buy its counterpart, Visa Europe, significant changes could be on the cards for Europe’s merchant community. Alistair Combes, Director of Knowledge, CMS Payments Intelligence (CMSpi) explains how profit-driven Visa Inc. could use the new interchange regulation as a platform to introduce new fees and how merchants must remain alert to new developments to ensure they are not paying over-the-odds.

Visa Europe is a payments giant; processing over 16 billion electronic transactions a year and managing in excess of 500 million accounts. To put the importance of the company in facilitating European commerce into context, Visa transactions currently account for one in every seven euros spent in Europe.

Given this, it is in the vested interest of the businesses that rely on the company’s services to remain alert to any disruptive changes. The news that Visa Inc. is in discussions to purchase its former subsidiary Visa Europe in a possible US$20 billion deal certainly falls into this category – and should be a major concern for European merchants.

Unlike Visa Europe, which is a not-for-profit organisation owned by some 3,078 banks and payment providers from 37 European countries that use its network, Visa Inc. is a New York Stock Exchange (NYSE)-listed company. Therefore, Visa Inc.’s priority is to act in the best interests of its shareholders – and with institutional investor shareholders to answer to, maximising profits are the order of the day.

To make matters worse for merchants, the recent announcement of the introduction of fairer interchange fees is sure to exacerbate the issue. Given that it will hit Visa Europe’s profits, it could subsequently act as a catalyst for Visa Inc. to increase merchant fees elsewhere to compensate; meaning the cost-reduction victory for merchants could be short-lived.

This is likely to drive increasing divergence in costs between efficient and non-efficient merchants. Vigilance is therefore essential.

Interchange: a long-fought battle

There has long been a lack of clarity regarding interchange fees (a processing charge levied to merchant acquirers by the cardholder’s issuing bank when a card payment takes place), with the amount charged for each transaction determined by an extensive number of factors, including the card scheme, card type, merchant sector and method of acceptance.

Furthermore, these charges are passed to merchants in various forms and with varying levels of transparency, making it difficult for merchants to understand exactly what they are being charged for. The level of interchange is said to cover a multitude of costs incurred by banks, including the running of customer accounts and associated overdrafts, the risk of fraud and bad debt, the interest free period, the costs of card production, systems and infrastructure, customer service, and any incentives/loyalty schemes often associated with credit cards.

With no material influence over how interchange fees are set, merchants are vulnerable to paying increased costs, such as those associated with the introduction of premium cards. Indeed, CMSpi estimates that UK interchange costs, for instance, have doubled since 2007.

The recent adoption by the European Parliament of regulation that caps interchange fees is therefore a welcome relief. The European Interchange Fee Regulation (IFR) enforces a maximum charge of 0.3% of the transaction value for domestic credit card payments and 0.2% for debit card payments. CMSpi estimates that such legislation could result in a saving of €4.2 billion per annum for merchants across Europe – an average reduction of 48% on their existing interchange bills.

A case of winning the battle but losing the war?

Yet Visa Europe’s sale may undo all of this good work. Though Visa Europe has not necessarily been an advocate for the new interchange regulation, it has been more supportive than its counterpart MasterCard. For instance, Visa Europe has established its (Visa) Cross-Border Domestic Interchange Programme (VCBDIP). The initiative, which was implemented on 1st January 2015, enables registered merchants to benefit from lower cross-border interchange rates for domestic consumer card transactions (in line with the European Commission’s regulated interchange fees) if their acquirer is based outside the merchant’s country of domicile.

MasterCard on the other hand has already announced it is to introduce new charges set to come into force in the second half of 2015. A “dispute administration fee” of €15 (£11.50) for all chargebacks raised within the MasterCard European region is to be implemented in August (in addition, MasterCard has removed its minimum value limit on Issuers to raise chargebacks), while the service fee charged for processing medium and high-value refunds within the MasterCard Europe region will increase from October.

With clear signs that the payments industry is viewing the new interchange regulation as a means of increasing profit margins – at the expense of merchants – the news of a potential buyout of Visa Europe by profit-driven Visa Inc. should certainly be viewed with an element of trepidation. Especially when there are already examples of Visa Inc. penalising merchants in the wake of the introduction of the Durbin Amendment, which was designed to offer merchants relief against debit card interchange fees in the US.

Indeed, since its introduction in 2011, Visa has inflicted a number of other fees on US merchants – including the highly controversial Fixed Acquirer Network Fee (FANF) – costing some of the larger companies millions of dollars per annum.

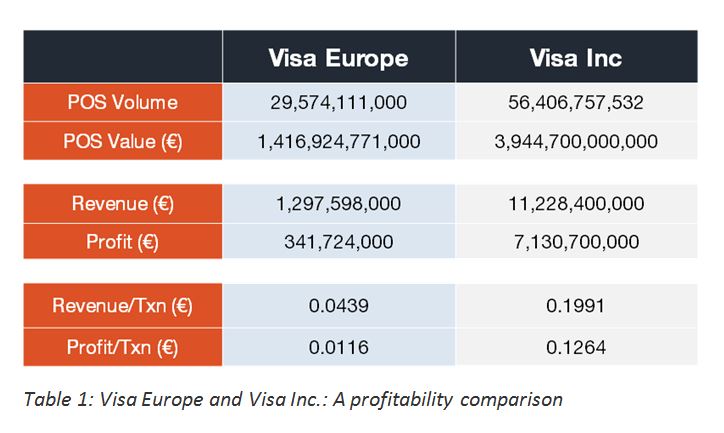

Such moves have protected the company’s profitability. Indeed, as Table 1 demonstrates, Visa Inc. enjoys both far higher revenue per transaction and profit per transaction than Visa Europe. Unfortunately, this is a discrepancy that Visa Inc. will no doubt wish to address to appease shareholders.

While it cannot be denied that the introduction of the IFR brings with it significant benefits for merchants, it has inadvertently triggered a platform for the introduction of potential “replacement” fees with broad, opaque titles such as “application fee”, “management fee”, “transaction fee” or even “kilobyte” fee, like has been seen in the US, as payment providers look for ways to rescue revenue.

While it cannot be denied that the introduction of the IFR brings with it significant benefits for merchants, it has inadvertently triggered a platform for the introduction of potential “replacement” fees with broad, opaque titles such as “application fee”, “management fee”, “transaction fee” or even “kilobyte” fee, like has been seen in the US, as payment providers look for ways to rescue revenue.

The IFR itself has created somewhat of a window of opportunity for such fees to be created and applied with the wording of its circumvention clause. While the regulation states that circumvention of the IFR via interchange replacement fees is prohibited, it does not rule out other scheme fees from replacing interchange fees. This clause is therefore not strong enough to protect European merchants from being vulnerable to the exposure of the introduction of the types of replacement fees witnessed in the US.

Remaining vigilant to ongoing change

While it remains to be seen exactly how the post-interchange regulation landscape will play out in Europe, developments witnessed in the US (and elsewhere, including Australia and Spain) hint towards the spawning of new fees as processors scramble to replenish their revenues. The possibility of Visa Europe being sold to Visa Inc. heightens this risk.

Yet merchants should take some comfort in the fact that the situation with Visa Europe is not clear-cut. Indeed, its shareholders are banks and acquirers that partly rely on merchant relationships for income and may therefore be less willing to risk enraging the merchant community.

One thing is clear, however. With so many changes occurring in the interchange space, merchants must vigilantly review and negotiate their charges if they are to ensure they are getting the best deals and using methods that help with cost savings. For example, CMSpi is already working to help its merchant clients minimise the volumes of chargebacks they receive in response to new charges being introduced by MasterCard.

While traversing complex charging structures can be a significant challenge, with the right approach it can be possible for merchants to obtain savings and put strategies in place that truly optimise their card supply chain.

Alistair is a payments advisor with over 10 years’ experience of retail payment acceptance operations and cost management. He specialises in global non-cash payments with a focus on breaking down & optimising end-to-end supply chain costs for the retail, hospitality and fuels sectors across major international markets. Alistair is a regular guest speaker at conferences and seminars covering innovations in the payments industry, interchange and costs of non-cash transactions.