Hedging risk, especially FX-risk, is basically a matter of volatility. Without volatility there is no risk of changing prices, i.e. values. That’s a basic principle. Quite often, corporate market participants try to fix that volatility by entering into a derivative product, e.g. FX-forward-outright for a single underlying. Doing it this way, it’s an attempt to eliminate changes in price with all their benefits, but also disadvantages. At the end of the day, the income statement is the report that monitors the efficiency of the hedge program. So, let’s concentrate on managing volatility of FX and how interest impacts the general ledger and the income statement:

Following explanations refer to Hedge Accounting according the International Accounting Standards (IAS).

Up until the beginning of this century, hedge accounting was practiced only in the US, under the SFAS 133. At the same time, the International Accounting Standards also considered hedge accounting as a common practice. Since then, international accounting standard IAS 39 has been born, which integrates itself harmonically into existing accounting standards, but in practice, is often considered as controversial and complex. The IFRS usually gives no choice of whether or not to adopt a rule, but in the case of the IAS 39, its acknowledgment is optional.

Permanent Change

Accounting standards, especially the IFRS, often change the contents of the standard. This is what happened with the IAS 39, which will be replaced by the IFRS 9. The following explanations refer to the well-established and adopted process that operates under the IAS 39 standard.

Basic Principles

Values, regardless of whether they are within the current ledger or occur in the future, are subject to regular changes because of multiple reasons. A common reason is the change of value because of currency movements. This may be because of existing balance sheet items (=translational) or future cash flows (=transactional). Those variations are considered in the common accounting principles as effective in the income statement. In consequence, it leads to unwanted side-results which have a significant impact on the profit or loss in a company. Currency deviations can be shaken out with countertrades (hedge) to the operational basic trade (underlying). Nevertheless, the result of the deviations is still considered in the income statement, as long as no hedge accounting is applied.

Because the subject matter of measurement and correct assignment of the hedging instrument to the underlying may become quite complex, the key question of hedge accounting is not the correct booking of items from income statement to general ledger. It is more how to identify and measure both trades correctly.

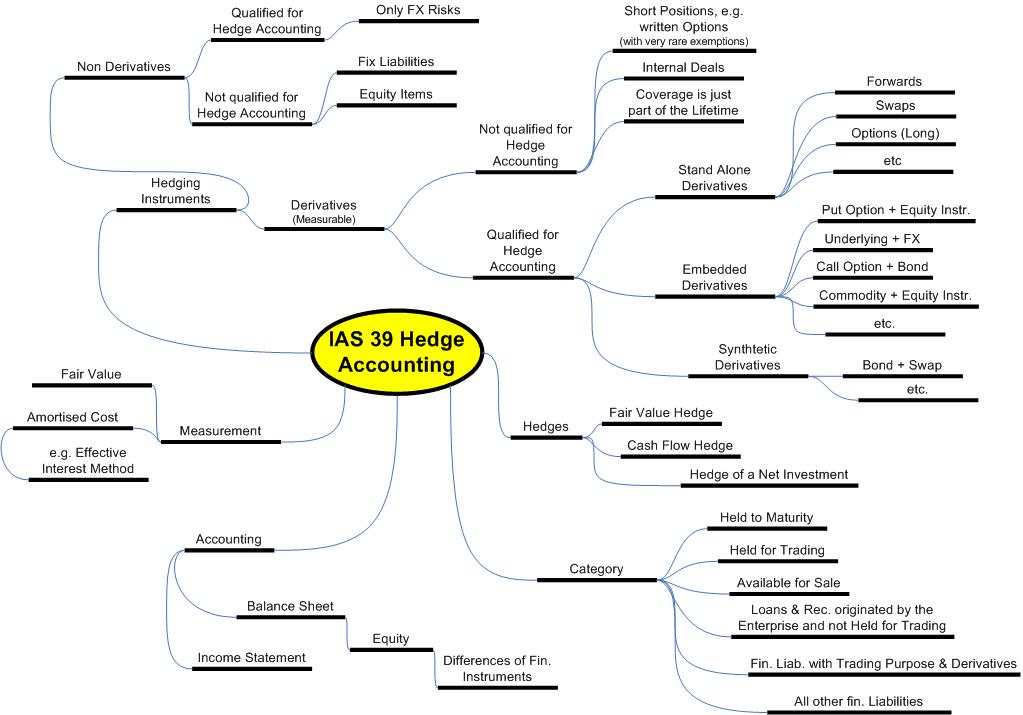

Source: Stahr GmbH – Treasury Consulting

This means that someone needs to be aware how the underlying will be classified and also how the hedging instrument relates to the underlying. If those characteristics meet symmetrically, currency deviations can be considered in the balance sheet in the equity part without affecting the income statement.

Requirements for Hedge Accounting

- The hedge must be highly effective (up to date at least 80%, maximum 125% -> but also in review by the IFRS board).

- High possibility of occurrence for the underlying which represents a risk for the company.

- A hedge must be effective during the whole lifetime of the underlying.

- It needs detailed documentation to describe the purpose and reason for the hedging transaction.

Example for a Cash Flow Hedge

- Reliability of the budget / finance or liquidity plan must be reviewed.

- Financial and operational capability of the projected activities must be given.

- The likelihood of impact for the underlying must be protected.

- Duration of the hedge will need to be considered: as the more distant an event is in the future, it is more unlikely to occur.

Example for a Cash Flow Hedge Documentation:

Company: Test-Holding abc

Hedge-Ref.: test123

Date: 30.06.xx

Underlying: Purchase of Company xyz as per 31.01.yy for the amount of CHF 10’000’000

Hedge Instrument: Forward Outright sale USD/CHF for CHF 10’000’000 at Citi Bank New York, Ref. 56789

Hedging-Type: Cash Flow Hedge

Description: “On 20.06.xx, the company Test-Holding abc and Company xyz agreed that Test-Holding takes over 55% of the xyz-shares for the price of CHF 10’000’000. The financing occurred by their own liquid funds in USD. In order that the calculated purchase price in the functional currency of Test- Holding does not change until the settlement date, the exchange rate will been fixed until that date. This represents a perfect hedge and the effect that is given during the whole duration.”

This example shows a 1:1 hedge, but there is also the possibility to summarise underlyings and hedges in portfolios. This requires correlation within the portfolio at a high degree and hedging instruments should match the risk-content of the underlying.

Not everything can be considered for Hedge Accounting

Hedging Instruments

Only instruments that are feasible for hedging can be hedged. Obligations like sold (written) Options, Short Positions and Equity Instruments all are not allowed or have very rare exceptions, especially with the SFAS. Trades within a corporate group are also not applicable because they would not offset the risk on a consolidated level. If a subsidiary would like to apply hedge accounting, it must give evidence that the hedge is made with a third party, even if this has happened as a second or third step through the group’s treasury service centre. Last but not least, instruments which do not cover the whole lifetime of the risk do not qualify.

Underlyings

For underlyings, it is postulated that they contain similar values. For example, cash flows from future purchases cannot be netted with cash flows from future sales and then hedged with one single instrument. It should be clear that underlyings can be identified and the effectiveness of the hedge is traceable so that a classification can be made.

Summary

Hedge accounting can be a very good technique to monitor deviations in values without an effect to the income statement. Thus, the net-result of a company can be reduced by unwanted side effects and is therefore, more related to operational items. The requirements are quite strongand might change from time to time. Therefore, it is strongly recommended to ask for competent support by introducing hedge accounting and also have the hedging process reviewed periodically by an independent party. That means, competence must be given not only in terms of accounting matters, a strong understanding of the hedging process is also needed.

Thomas started in foreign exchange at UBS in Zurich in the early 90’s and then took on Assistant-, Treasurer- and Group Treasurer (VP) roles at medium and large sized corporates. Thomas now has 26 years of professional experience all across the treasury industry and since 2007, he has serviced in his own company as a Treasury Consultant, Interim Manager and Trainer for small-, mid- and large corporates.

Thomas started in foreign exchange at UBS in Zurich in the early 90’s and then took on Assistant-, Treasurer- and Group Treasurer (VP) roles at medium and large sized corporates. Thomas now has 26 years of professional experience all across the treasury industry and since 2007, he has serviced in his own company as a Treasury Consultant, Interim Manager and Trainer for small-, mid- and large corporates.