Changes to the industry since the crash mean that a revamped ALM industry is more and more necessary - and the biggest shift will see treasurers move from a reactive to a proactive approach, says Professor Moorad Choudhry.

As previously discussed, asset-liability management (ALM) is the core risk management discipline in banking and one that is practised by every bank, regardless of size, business model or customer franchise. But like many aspects of banking, the changes in the industry taking place since the crash demand that this most traditional of disciplines must also undergo a revamp. Best practice in ALM now requires that we move from the reactive form of ALM undertaken in most banks to a much more proactive form. This is Strategic ALM, and it’s set to become the modern, business best-practice way to conduct balance sheet risk management in banks.

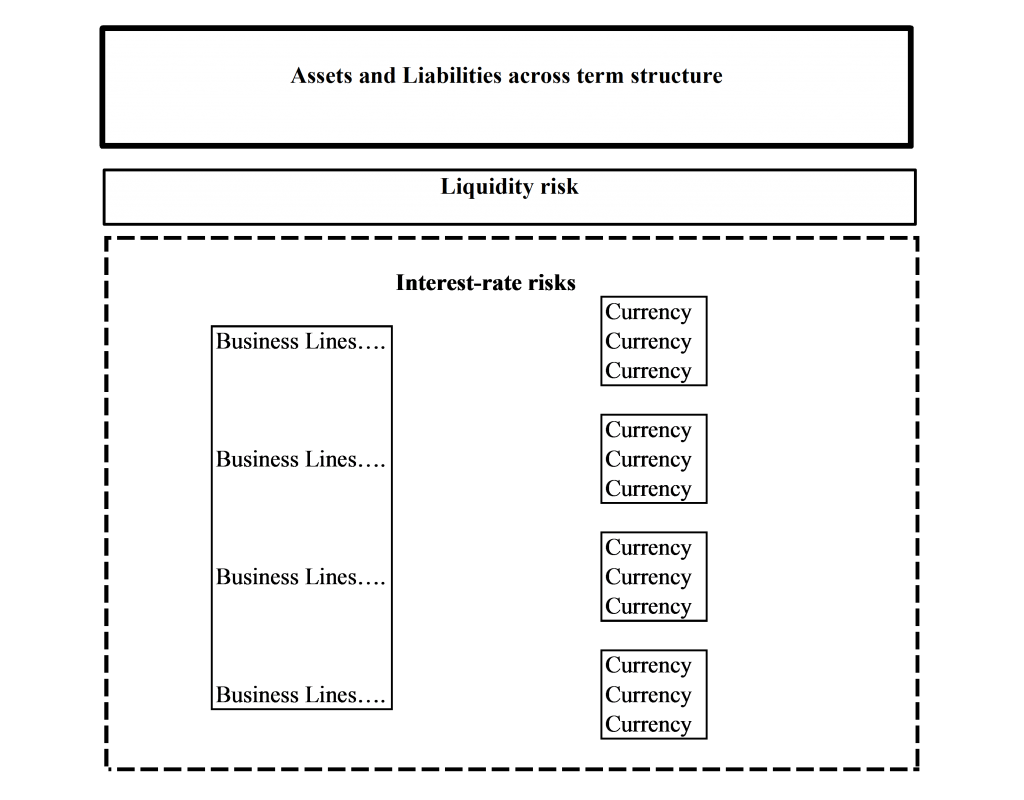

Ask any practitioner what they understand by ALM and most of them will say something along the lines of the following: it represents the management of liquidity risk and interest-rate risk in a bank. More fundamentally, they will expect that the way it works is that the business lines go out and originate loans (assets) and raise deposits (liabilities), and then the mismatch in tenor and interest-rate basis of these assets and liabilities generates risk exposures that must be managed. It’s a requirement and an art as old as banking itself. Exhibit 1 is a traditional view of ALM.

Exhibit 1 Cornerstones of ALM

(Source: Choudhry, Bank Asset Liability Management 2007)

But this is ALM after-the-fact. Assets and liabilities are generated separately, often in a silo-style organisation structure, with little interconnection between the two. The business lines work to budget targets and P&L targets, and the risk manager comes in afterwards and manages the exposure.

This is old-style ALM. In the Basel III era, we need to be much more joined-up in our approach to ALM, because the higher cost of regulation (more capital buffers, higher capital levels and greater cost of liquidity reserving) means it is imperative that banks optimise the balance sheet from an ALM perspective. In other words, ALM turns into a proactive discipline and the ALM desk (and its ultimate boss, the ALCO) has a greater say in the way the business lines conduct business.

Welcome to strategic ALM. I define this as follows:

A single, balance-sheet-aggregate, integrated approach to risk management that ties in asset origination with liabilities raising.

There would be no more siloed organisation in banks, and asset originators would have an interest in the appropriate-ness of the funding type and source, just as the deposit raising business would be concerned that the funding type and source in place is appropriate to the assets being funded. To take an extreme example, if one is proposing an infrastructure lending business, one would ensure that the funding for it was suitably long-term and stable, and that the loan pricing incorporated the correct term liquidity premium.

This approach requires the bank to consider simultaneously:

- The liquidity and regulatory requirement aspects of all balance sheet funding;

- The NII/NIM aspects of the assets;

- The customer franchise aspects.

Strategic ALM is a high-level, strategic discipline driven from the top down (by ALCO), to arrive at a balance sheet that is shaped and structured by design rather than accident, by purpose rather than as a result of history and business lines pursuing their individual goals. By doing this, a bank is better able to optimise the balance sheet from an asset and liability mix perspective, and the ALM desk is better able to do its job managing balance sheet risk.

This is why Module One (of the five modules) of the BTRM programme concentrates on how best one should be implementing strategic ALM concepts, because by doing so from the start an ALCO is better able to influence the risk management culture in place at the bank. There is also a better chance of the bank being able to have an optimum balance sheet structure, which has to optimise three competing aspects: regulatory requirements, NII/NIM maximisation and preserving customer franchise.

In the post-crash era ALM also needs to take in credit risk. Whether ALCO has an oversight function over the credit risk committee, or the Treasury function has an input to the credit risk management process, or by some other means, it can be argued strongly that for an ALM desk to be a true manager of balance sheet risk it must have some form of oversight over the credit risk process. What is by far the biggest risk exposure for virtually all commercial banks? Credit risk of course. So to be able to claim an effective control framework over the balance sheet, it is logical that ALCO also have oversight of credit risk policies and guidelines.

The need to be more proactive in ALM, and allow ALCO as a whole to have a greater say in the ultimate shape and structure of the balance sheet, reflects this need to ensure balance sheet optimisation. Applying an aggregate balance sheet approach via Strategic ALM has implications for the following:

- Risk appetite;

- Target return on capital;

- Target operating model;

- Approaches to managing and mitigating balance sheet risk;

- The strategy setting process.

Because of this, it is important for all parts of the bank, from the customer-facing businesses to the middle office, risk and support functions, to be involved in the debate on how best to ensure optimum balance sheet structure and how best to ensure an effective ALM and risk management process. This debate would necessarily take place at ALCO, and ultimately ALCO would agree the best process for implementation.

Professor Moorad Choudhry is author of The Principles of Banking (John Wiley & Sons Ltd 2012) and founder of The Certificate of Bank Treasury Risk Management (www.btrm.org)