The maintenance of stable, robust funding has been an imperative of all banks since banks were first created. But like all objectives that are more art than science, devising an effective metric that gives an accurate picture of the funding position of a bank has proved somewhat problematic. This is unsurprising, as funding status can be measured in a number of ways and the bank’s executive will require a forward picture as well as a stressed versus BAU picture. And then there is the issue of business model: a single-branch UK building society will require different metrics to a secured-funded investment bank, for example.

In the Basel III regime though of course one size fits all. Compliance with liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) is required of all banks, irrespective of their business model. But to what extent does a particular value for either metric inform us of the stable funding position of a bank? Put another way, how useful are LCR and NSFR for actual balance sheet management purposes?

One could say that this is an irrelevant question: compliance at or above 100% is mandatory for both metrics, so that’s all there is to it. Up to a point this is not illogical; however the management imperative is to maintain funding robustness through the cycle. In that sense, management decisions will require the use of another set of metrics.

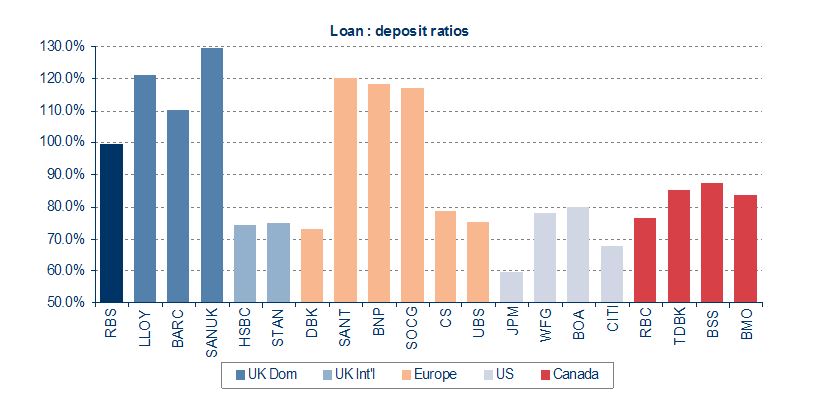

Consider the exhibit below, the publicly available loan-deposit ratio observed for a group of peer banks at one point in 2013.

Exhibit 1: Peer group banks loan-deposit ratio (LDR), 2013

Source: Annual reports

One would not conclude that one bank was necessarily more stable funded, today or going forward, simply on the basis of this one metric being higher than that of its immediate peers. If one could make a similar comparison for LCR or NSFR, the picture would not necessarily be clearer.

From a management perspective, the issue is complicated because of the inherent assumptions-based nature of both calculations. At least the LCR value is calculated from only one set of assumptions – those that make up the denominator. The NSFR value represents a fraction of two assumptions, both numerator and denominator. In a stressed environment, the actual behaviour of various liability types cannot be known with certainty.

The business of banking requires us to take on liquidity risk, by definition. But in the Basel III era we need to understand our liabilities to a very full extent. Consider the term funding value of the following types of funding:

- Senior unsecured capital market FRN

- Covered bond

- RMBS

- Equity-linked structured note

- Derivative collateral inflows

- Retail customer “operational” deposits

Each of these represents a form of term funding, but which is the most valuable for the bank (from a stable funding, rather than NII, viewpoint)? To be certain under all circumstances one may conclude the fixed-term FRN with a contractual maturity of (say) 5 years is the most solid, but this may well be the most expensive form available. But while any of the above will assist the NSFR value, it does not necessarily follow that the balance sheet is equally stable irrespective of the funding type.

Of course the capital markets are not available to every bank. Some banks will struggle to raise liabilities from this source. To ensure NSFR compliance such banks may well require the use of certain customer deposits under assumed properties. In essence though bank Treasury desks will need to maximise their funding sources as well as diversify them. The solution to funding robustness over the cycle may well be NIM-destroying, but an ability to tap capital markets, of various types, remains important for banks.

This is the primary reason behind the nature of the content that is “Module 3” of the BTRM. All bank Treasurers, irrespective of the size of the institution they work at, need to keep abreast of the developments in capital markets and their ability to tap them. This is not a static picture as supply and demand are of course dynamic. As the date for banks to be NSFR compliant gets closer, for some banks there may be no alternative but to access capital market investors, whether in the secured or unsecured space, to ensure that the Basel requirements are met. Knowledge of this space is vital for Treasurers and this is why this topic is an important part of the BTRM syllabus.

Professor Moorad Choudhry is author of The Principles of Banking (John Wiley & Sons Ltd 2012) and founder of The Certificate of Bank Treasury Risk Management (www.btrm.org).

Professor Moorad Choudhry is author of The Principles of Banking (John Wiley & Sons Ltd 2012) and founder of The Certificate of Bank Treasury Risk Management (www.btrm.org).