Times are changing as technophile CEOs and CFOs increasingly demand contemporary offerings from their banks to optimise working capital and mitigate risk. As such, the Bank Payment Obligation – a new instrument in trade finance – has real potential to revolutionise the transaction banking industry, particularly for SMEs, but also large corporates. Yet scepticism remains and the number of transactions completed using the BPO are still relatively low. Angela Koll, Product Manager Trade Services at Commerzbank AG, explains how Commerzbank overcame the challenges to successfully complete its first BPO transactions last year.

It is high time that leading trade finance banks wake up to the potential of the Bank Payment Obligation (BPO). Two years on from the introduction of the ICC Uniform Rules for Bank Payment Obligation (URBPO) and many banks are still biding their time waiting to see who else will adopt this innovative instrument before they jump on board. This is a shame, given the BPO’s potential to transform laborious paper processes and bring trade finance services well and truly into the digital era.

Of course it is not only banks, but also corporates who remain on the fence. Yet, in order to convince all four parties, including the buyer, seller and their respective banks to proceed with a live BPO transaction to derive the benefits of this innovative solution, more transactions will need to take place in the market.

Fortunately, with the BPO’s arrival in Europe last year and the four banks that achieved pilot transactions here, we are making steps in the right direction. However, progress is still fairly slow. Especially when compared to the BPO’s rise to prominence in Asia, where higher numbers of corporate clients and banks are undertaking BPO transactions; in part, thanks to their willingness to embrace innovation in the market.

While Letters of Credit (LCs) provide excellent risk coverage for trade – and always will – their highly complex manual-based processes cause them to have relatively high transaction costs. As such, companies engaging in trade are increasingly turning to alternative and less costly trade services, such as trading on open account. Indeed, current estimates from SWIFT suggest that a staggering 90% of world trade is now being conducted on open account. Yet the BPO can offer numerous advantages over open account business. And now might be the right time for adoption.

BPO as a compelling solution

Certainly, we are seeing increased demand for working capital optimisation tools and risk mitigation from our corporate clients, particularly on the open account business side. Therefore – as has been well-documented – the BPO can provide an additional tool to traditional trade finance instruments for some businesses as it both ensures the viability of settlement by open invoice, and allows optimisation of working capital and provision of liquidity.

To recap, the BPO is an irrevocable undertaking by a buyer’s bank to pay a specified amount to a seller’s bank following successful electronic matching of trade data previously agreed by buyer and seller.

Significantly, the BPO is not only a trade finance tool, but an enabler of supply chain finance (SCF). Indeed, BPOs present an opportunity to provide post-shipment financing to suppliers, allowing them to access finance at earlier stages in their supply chain cycles. Importers will also benefit from finance opportunities which go along with the BPO.

While SCF solutions have traditionally been the preserve of larger multinational corporations, the BPO will also allow smaller companies to benefit from financing opportunities. This is due to the fact that the BPO can act as a security of payment for the exporter’s bank based on fast and effective data matching processes, thereby facilitating post-export financing.

Certainly, there are promising opportunities associated with the BPO. Yet many banks and corporates remain sceptical of such a new product entering the decades-old trade finance market. However, as Commerzbank proved last year, unlocking the theoretical benefits associated with the BPO is far from unachievable.

Commerzbank’s maiden BPO transactions

Last year, Commerzbank, was among the first banks in Europe, together with Unicredit, to process successful BPO transactions. Both of Commerzbank’s transactions – one for a German SME and the second for an international group of companies based in Belgium – took a number of months to complete owing to the main challenge of onboarding the other three parties.

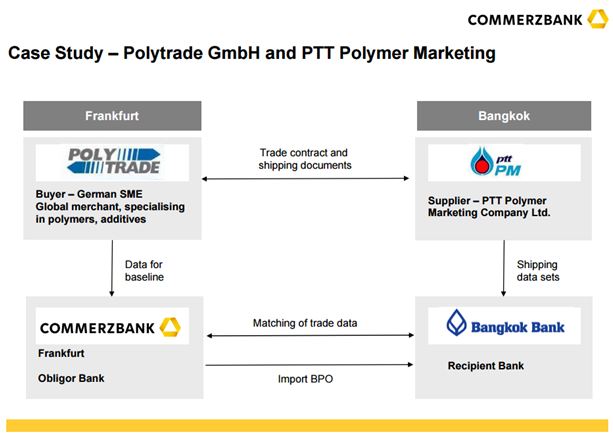

Frankfurt-based Polytrade GmbH, a global merchant specialising in polymers, additives and polymer chemicals, was the company behind Commerzbank’s first BPO. It used the BPO to receive payment from its supplier in Thailand, PTT Polymer Marketing Company Ltd., whose bank partner was Bangkok Bank.

Polytrade and PTT have a longstanding trade relationship. Prior to using the BPO, their business was handled using Import LCs with deferred payment terms of 60 days after bill of lading date. According to Polytrade, the BPO was ideally suited to them for the ongoing optimisation of internal payment handling processes. In addition, the BPO provided the company with a number of efficiency benefits through reduced document handling, shorter processing times and cost savings. Following the first live BPO transaction, Polytrade continued its BPO business with Commerzbank and also started processing BPO transactions with UniCredit.

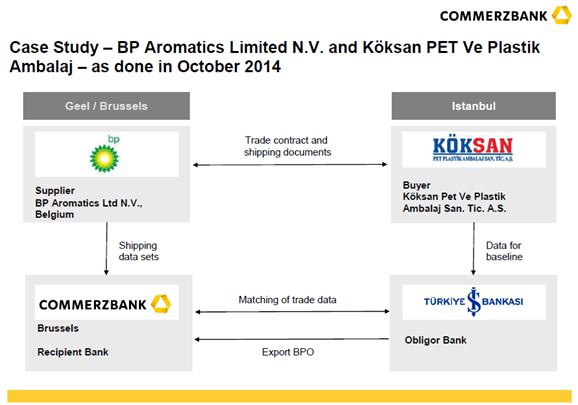

Commerzbank’s second live transaction involved BP Aromatics Limited NV, a Belgium-based group, which agreed to process payment from its Turkish business partner, Köksan Pet Ve Plastik Ambalaj San. Tic. A.S. using a BPO.

Commerzbank’s second live transaction involved BP Aromatics Limited NV, a Belgium-based group, which agreed to process payment from its Turkish business partner, Köksan Pet Ve Plastik Ambalaj San. Tic. A.S. using a BPO.

In BP Aromatics’ case, using a BPO offered crucial benefits with the electronic processing allowing for greater flexibility in terms of changes to shipping or trade terms. For example, when shipping goods from Port A, but wanting to amend the shipping terms for shipment from Port B, the automation of the BPO allowed any transaction adjustments to be made at short notice whereas this would have taken a number of days to come through using the LC.

Also important for BP Aromatics was the fast establishment of the “BPO baseline”. The BPO works by electronic matching of data through the SWIFT platform, SWIFT TSU, by establishing a “baseline”, containing purchase order data and shipping document data, taken from invoices, transport and other documents. The data is provided by buyer and supplier, forwarded by banks to the platform and matched electronically. Upon successful matching of shipment data against the baseline, the BPO becomes due. Payment at maturity date is then processed outside the BPO. This electronic handling significantly reduces processing time. Of course, BP Aromatics also enjoyed the assured risk mitigation and reduced pricing, but flexibility was the key driver for undertaking a BPO transaction in this case.

Now that the BPO has entered the EU market, we are confident adoption will continue to grow. We only have to look at the recent announcement from essDOCS – one of the major platforms for electronic trade document transmission – which saw its first use in support of a BPO, to understand that new ground is being broken for the normalisation of electronic trade documents. A first live transaction of a BPO connected with the issuance of an electronic bill of lading was announced by SWIFT in April 2015 and has set a milestone for the increased market adoption of the BPO. Furthermore, the fact that non-bank vendors in the market are seeking to create a proposition in the BPO space is positive progress for all.

The dynamic growth of global trade over the past decades has only been made possible by the rapid expansion in trade finance. As such, we as banks have to stay ahead of the curve in order to offer corporate clients the contemporary solutions they require and this means embracing innovation.

Angela Koll is Vice President, Commerzbank AG Frankfurt. Angela joined Commerzbank in 1990 and has worked in documentary credit departments in Frankfurt and London. After six years working as a specialist in transaction banking for trade finance in the Frankfurt Head Office, Angela later specialised in sales strategy for international business. In 2014, she moved into product management for trade finance and recently started working in Trade Services Advisory for Supply Chain Finance at Commerzbank. Angela supported Commerzbank’s processing and international market launch of the first live BPO transactions in October 2014. She is a member of the Global SCF Forum Drafting Group and the EBA SCF Working Group in Brussels.

Angela Koll is Vice President, Commerzbank AG Frankfurt. Angela joined Commerzbank in 1990 and has worked in documentary credit departments in Frankfurt and London. After six years working as a specialist in transaction banking for trade finance in the Frankfurt Head Office, Angela later specialised in sales strategy for international business. In 2014, she moved into product management for trade finance and recently started working in Trade Services Advisory for Supply Chain Finance at Commerzbank. Angela supported Commerzbank’s processing and international market launch of the first live BPO transactions in October 2014. She is a member of the Global SCF Forum Drafting Group and the EBA SCF Working Group in Brussels.